09.11.2011

Investment is a phenomenon for which, you pay the price and get value. Investment can be short term as well as long term. Long term investments are always more fruitful than the short term investments with a relatively higher degree of risk.

The case of Gordon Murray regarding his terminal illness and his business is a striking example that can be taken to discuss financial investments and the risks involved in it. Gordon Murray in 2010 stopped the medication for his brain tumour and thought to divert his energies in writing a book on personal finance with his friend and personal advisor, Daniel Goldie. They named the book as, “The Investment Answer,” which was depicted on Mr. Murray’s 25 years of experience in Wall Street to provide readers with his finest insight on personal investments.

The investment advice shared by the Banker – The New York Times justifiably got fascinated by Mr. Murray’s book and his personal experiences regarding his investments and tenure as a banker. The newspaper inquired Mr. Murray about his experiences and his best advice. Strangely, they found that Mr. Murray considered his companionship with Mr. Goldie more precious than his few years professional work relation with Lehman Brothers, Goldman Sachs and Credit Suisse First Boston.

5 Decisions recommended by Mr. Murray to all the investors

Following are the 5 golden decisions that Mr. Murray advised all investors to make in order to get a fruitful reward from their investment.

- Will the investor invest alone or with the help of an adviser? – This question lays the foundation stone of the proposed investment. It is a self assessment of the investor that whether he has the right confidence and resources to invest alone or need help of an adviser.

- How will be the money divided? - This question addresses the distribution and span of the investment. It is believed that a volatile investment portfolio earns more over time.

- How will be the domestic and foreign investments divided? – The idea is to formulate the investment on the basis of domestic and foreign sectors.

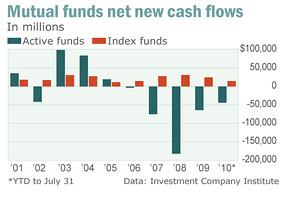

- Will you prefer to invest in passively or actively managed mutual funds? – This key decision is solely at the discretion of the investor and should be taken according to the present scenario of the investment.

- How will be the rebalance of portfolio be done to improve return on investments? – This question asks the investor to incorporate all small attributes that could affect return on investments.

Rejecting the American way of Investment

Mr. Murray believes that Americans are wrong in thinking that only hard work can bring good return on investments. In fact, for people investing on individual levels, the market is just like a force of nature than a dilemma to be cracked. This is the reason for advising investment on passively managed funds. Hard work is no doubt commendable, but hard work without correct information and knowledge will always keep you far from success.

For further informative blogs and articles on business, personal finance, investment, budgeting and savings, please log on to Homemony and get a deeper insight of the related issues now.